Themes and Insights From the 2025 ProSight Community Bank Survey

8/12/2025

ProSight’s 2025 Community Bank Survey reveals an industry segment that is feeling pressure from tariffs, fraud challenges that are flashing red, and a possible future where fewer customers appreciate smaller banks the way they once did. At the same time, attention to community and personal relationships is still a key feature of this long-successful business model.

The survey was taken in spring and early summer 2025 by community bankers representing 115 ProSight member institutions across the U.S. Informed by post-survey interviews with the association’s Community Bank Council members plus an analysis of the survey results, this report explores key themes and topics that emerged from the research.

The Industry Is Addressing Fraud, But More Work Is Needed

Old-school crimes such as check fraud and customer scams (romance, elder, etc.) top the list of concerns, while fraudsters using sophisticated new technology such as generative AI are finding new and smarter ways to attack banks and customers across all fraud types. Despite saying that they’re adequately prepared (73%) today with the resources they need to fight fraud, three-quarters said they would spend more next year on fraud than they have this year.

“It's training. It's technology. It's customer education,” said Thomas MacDonald, chief credit officer at Maine Community Bank. And it will take cooperation too. Nearly all survey takers agreed with the statement: “Stronger coordination and information sharing among financial institutions is required for our industry to make major strides in fighting fraud.” That insight is part of what’s prompting ProSight to create the Fraud Alert Network, launching this fall.

“Banks need to work together better on this. That's something we don't do well,” MacDonald said. Melissa Torres, vice president of loan operations at Fitchburg, Wisconsin-based Oak Bank, said there have been cases where fraudsters work their way through the industry with the same exploit, yet many institutions remain unaware until it affects them. A common example? Texts that claim to be from a bank’s fraud department, but are actually intended to pry loose sensitive customer information.

In addition to receiving cooperation from each other, survey respondents mostly agreed that banks need substantial support from law enforcement (83%) and government more generally (76%) to fight fraud. Robin Ingari, executive credit risk officer at Corpus Christi, Texas-based American Bank, said the U.S. Post Office could play a role by improving the security of drop boxes, where fraudsters often fish for material to ply their trade.

In written comments, survey respondents noted the balance between the need to prevent fraud while not frustrating customers with steps that slow down transactions. “Our BSA/Fraud [function] is prepared,” one survey taker said. “However, the production side of the bank continues to push for less-friction account opening, which leads to more new account fraud.”

Bank customers may think “it’s too much work” to take certain fraud precautions, Ingari said, but “all that needs to happen is they get hit once and they become huge proponents.” As for banks, she said, stepping up fraud prevention is “going to cost you some money but it's going to cost you more on the other side” if fraudsters succeed.

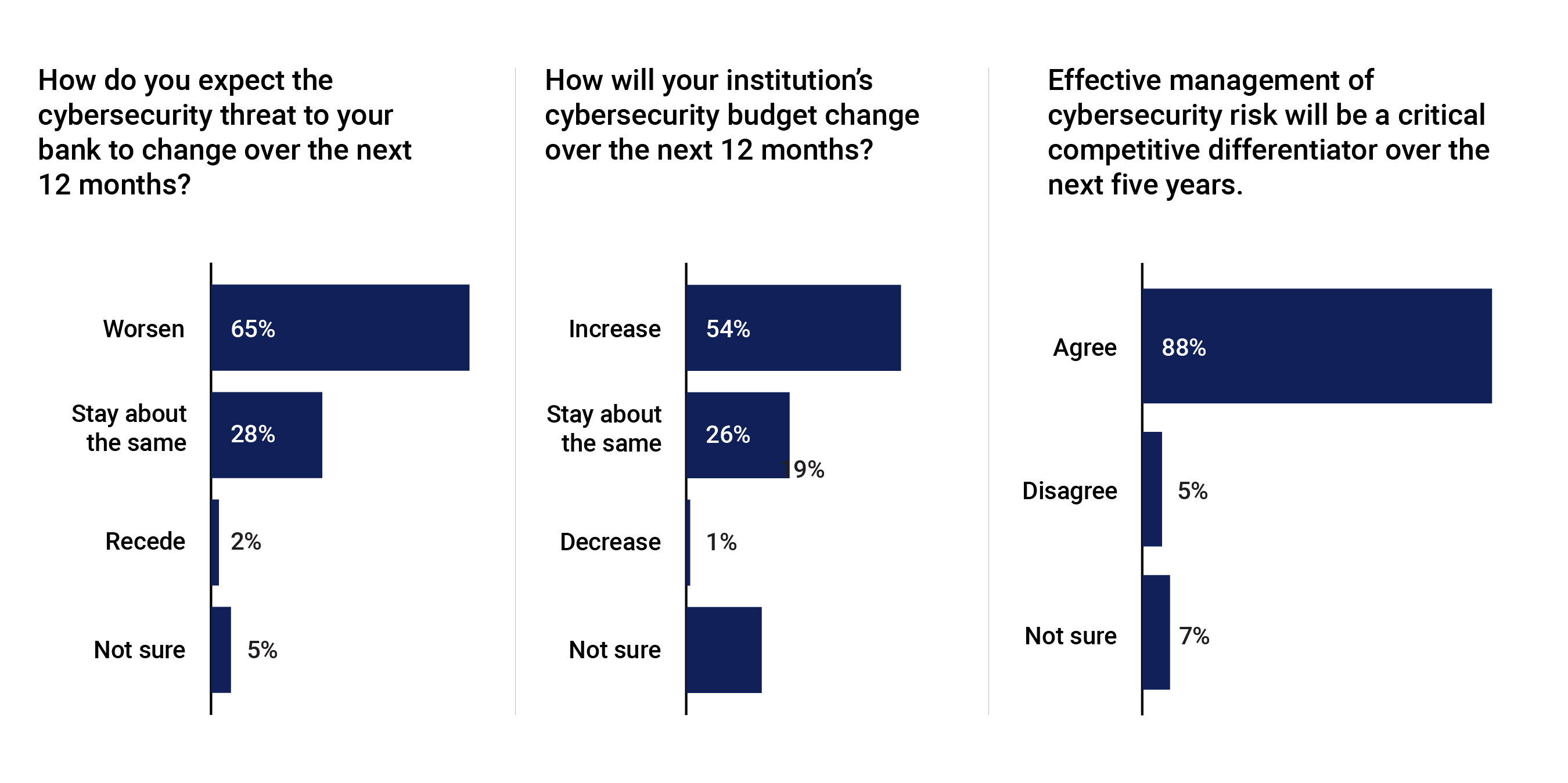

On the oft-related cybersecurity front, nearly two-thirds of respondents (65%) said that the threat of cyberattacks would worsen in the coming year. Fifty-four percent are increasing their level of cybersecurity investment. Eighty-eight percent agree that effectively managing cybersecurity will be a critical competitive differentiator over the next five years (see Figure 1).

Figure 1. As cyber threats escalate, banks boost spending

In written survey comments, one respondent noted a “concerted effort to inform staff and clients of the existing fraud and cybersecurity risks” and to “educate as much as possible.”

Others said they were pursuing “more training of personnel on changes in cybersecurity as it relates to the banking community” and investment “in tools to uncover and stay abreast of [the] latest schemes.” Several said they would use or are using AI in cybersecurity and fraud-prevention programs.

Regarding artificial intelligence writ large, 80% of respondents agreed that using AI effectively would be critical to meeting strategic objectives over the next five years, while 9% disagreed and 11% said they were not sure.

It’s Not Just the Tariffs, It’s the Uncertainty

Tariffs are dominating risk dashboards. Tariff-related risk (named by 28% of respondents) was behind only fraud and financial crime (37%) and cybersecurity risk (32%) when the survey asked respondents to name the top three concerns for the next 12 months (see Figure 2). In a separate question, nearly three-quarters (74%) agreed that economic disruption related to tariffs posed a meaningful threat to their banks’ performance.

Figure 2. Fraud, cybersecurity, and tariff-related risks dominate risk outlook

“There is a lot of uncertainty surrounding tariffs,” said MacDonald, the chair of ProSight’s Community Bank Council. “And whenever there's uncertainty, it's going to jump to the top of the risks people are identifying.”

“Uncertainty with our commercial borrowers,” MacDonald said, “may result in them limiting or delaying investments—which could result in a lower loan demand on our end.”

In many cases, said Deanna Cavanaugh, chief credit and risk officer at Connecticut Community Bank, tariff “pain will be distributed among different parties—the importer, the manufacturer, the distributor, the retailer, and the consumer—and will largely not be a major threat.” In other cases, though, it will be sizable, she said. Ingari gave the example of tariffs on Japanese goods. The average tariff had been 1.6%, she said. Now it is 15%. The difference may be a company’s “entire profit margin,” she said.

Another concern, Cavanaugh said, “is not the actual tariff but the small business owner who doesn't necessarily understand they have to pay a tariff.” A few years ago, she said, “a customer was obligated to pay tariffs and didn't know. The government did an audit, and they got assessed with significant past-due tariffs and penalties.” Combined with other factors, she said, that “ended up putting the company in bankruptcy.”

Torres said her institution is analyzing the level of tariff impacts on borrowers seeking new funding. Lenders are asking: “Where are you getting your supplies? Which vendors are you working for? Where are you in the supply chain?” she said.

Insurance Is an Emerging, and Spreading, Risk

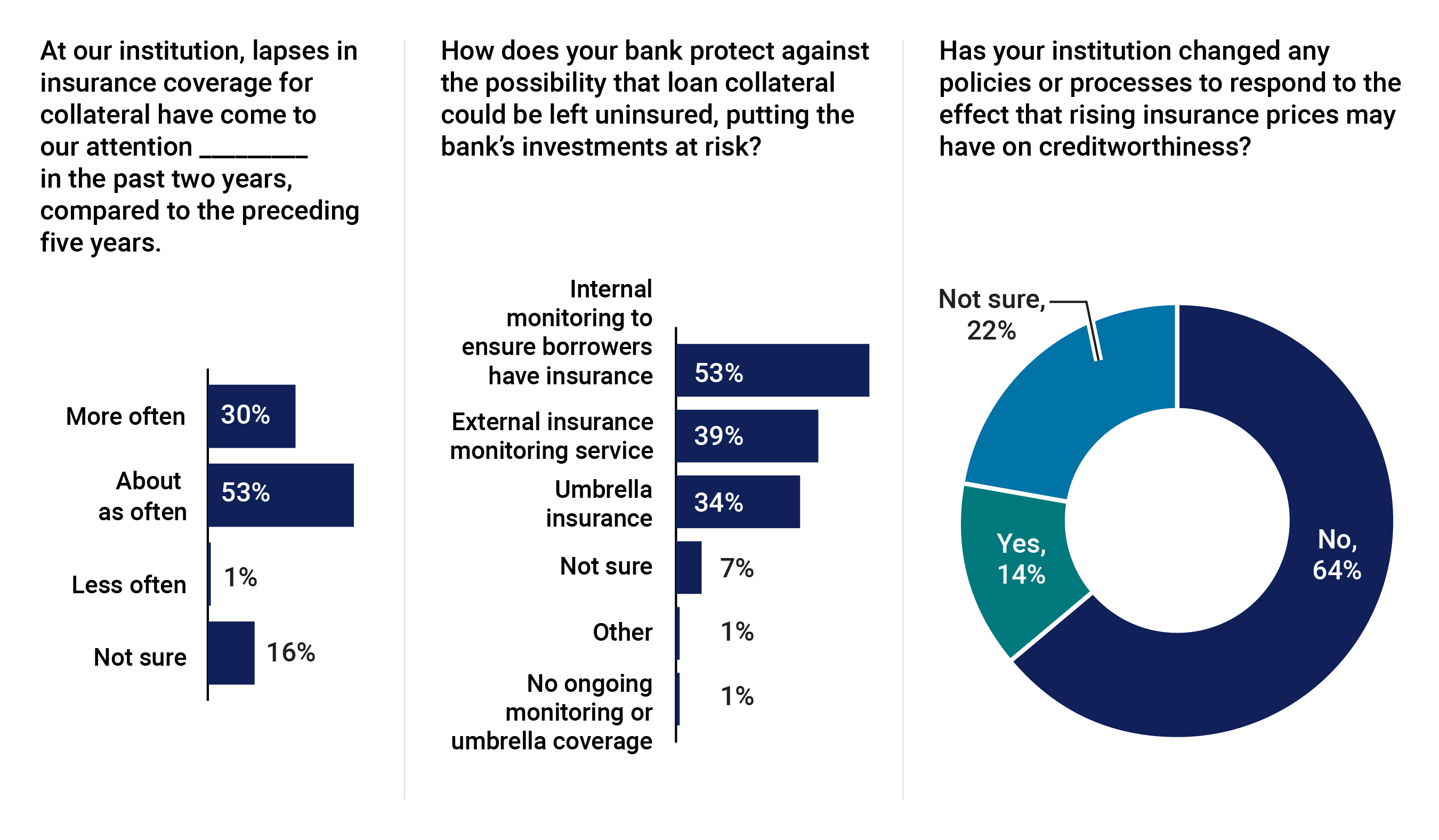

Weather events’ contribution to rising costs and market retrenchment by insurance providers are creating potential collateral exposure in banks’ loan portfolios. Nearly a third (30%) of respondents have noticed an increase in insurance coverage lapses in the past two years compared to the five years prior. About half (53%) said they haven’t seen much change.

Many banks already take preventive measures to monitor collateral insurance coverage, running their own in-house monitoring operation (53%), farming oversight out to a service (39%), and/or buying umbrella coverage (34%) to protect against exposure and losses.

Pricing in some markets can be stifling. But most banks (64%) currently don’t see a need to factor the high cost of insurance into credit evaluation models for borrowers (see Figure 3).

Figure 3. Rising lapses in borrower coverage drive insurance monitoring and umbrella coverage

The response is likely tied to the fact that it is a regional issue, with certain states more prone to extreme weather and disasters, Cavanaugh said. In those places, she said, “Some carriers are pulling out of those markets,” driving borrowers to “state-sponsored insurers of last resort that are very costly.”

Another issue is borrowers who accept higher deductibles on their properties—the bank’s collateral—in exchange for lower-cost premiums. “Not only do I have to make sure [borrowers] have insurance,” Cavanaugh said. “I also have to make sure that their deductibles are reasonable—so if there’s a problem, they can actually meet that [deductible].”

But sometimes, Ingari said, a lower deductible cannot be had for any price. In Texas, she said, apartment complexes commonly have deductibles of over $100,000 for hail damage and the owners “don’t have a choice” to opt for a lower deductible. “I don’t think anyone in Austin can get a full roof policy without a large deductible on it,” she said, adding that lenders “have to understand that and put that in loan decisions.”

Rising insurance costs plague commercial as well as residential real estate, Cavanaugh noted, saying “it can be a big component of operating expense”—and may loom larger in the future depending on the trajectory of prices. “You're doing your underwriting today,” Cavanaugh said. “What happens in three years? What happens when they can't afford the insurance?”

Another concern is extreme weather hitting areas previously considered low risk. “The disaster areas are expanding a lot faster than people realize,” Ingari said, noting the seeming expansion of “tornado alley.”

With insurance and, in some areas, tax rates soaring, Ingari said it’s not uncommon now for the escrow allowance for taxes and insurance to exceed principal and interest payments. “We're looking at [borrower] liquidity a lot harder because of that,” she said.

Office CRE Struggles

A relatively small percentage of respondents see office real estate exposure as a serious problem for their institution, but a majority are making special efforts to mitigate office CRE risk. While only 1% of respondents strongly agreed, and 20% somewhat agreed, that the segment would pose a significant risk to performance over the next two years, an overwhelming majority had already taken or were planning to take several steps. Fifty-four percent reported that they had increased their portfolio monitoring, including for concentrations, and 17% said they were planning to. Other common responses include increasing stress testing (66% have already or plan to do so), limiting the market (50%), and tightening lending policies (42%).

On the other hand, a CRE segment is largely seen as a bright spot. While respondents commonly listed non-Small Business Administration (SBA) lending (41%), mortgage origination (24%), and SBA lending (17%) among their top three current business opportunities, their biggest agreement was on owner-occupied CRE lending (49%), as shown in Figure 4. Council members said it was in a sweet spot, presenting relatively low risk for the return it can bring: The business that inhabits the real estate generates cash flow independent of the vagaries of the real estate market, while at the same time the real estate is collateral for the lender. “And because it's a commercial and industrial loan,” Ingari said, “it doesn't go into the 100 or 300 [concentration] bucket.”

Figure 4. Commercial real estate and conventional small business lending are the best near-term opportunities

Aside from tariff, insurance, and CRE-related credit risk, survey takers also addressed credit risk in general. Both consumer and commercial and industrial credit risk were named by 11% of respondents as top current risks.

Interest-Rate Risk

In the past year, the industry surrendered hopes of returning to the historically low interest-rate environment prior to this latest tightening cycle. Instead, they’ve accepted the realities of a higher-for-longer regime. Almost 80% said they expect rates to exceed pre-pandemic levels even if the Fed begins a cycle of easing. More than half (57%) say they’ve partially adapted their asset/liability mix to a higher interest-rate environment, while another 34% have fully adapted.

Where they see higher interest rates having a lasting effect is in the competition for deposits. Almost all respondents (96%) believe competition for deposits will remain tough even if rates decline.

One respondent noted that “interest-rate risk is being managed through minimum rate spreads, rate shopping, and profitability analysis.” Another reported: “We have implemented our first back-to-back interest-rate swap to mitigate some interest-rate risk.”

The Aging Customer Base

Eighty percent of respondents said that their customers are aging and that a younger target customer doesn’t appreciate the banking model.

For some banks, attracting a younger client involves launching new products, with a focus on payments/money transfer services (38%), tie-ins to a digital wallet (32%), and money management (29%), as shown in Figure 5.

Figure 5. Banks appeal to younger customers with technology-based offerings

“We've been able to launch different products and services in the hopes that we can attract that next generation,” Torres said. The effort also includes “being as personable as we can with that older generation and getting to know their families.”

Torres said her bank is also trying to ensure the younger generation is represented in its customer-facing workforce “to attract a younger client base.”

“We have to make sure we maintain the current mix of products and services for our existing client base, while adding what the newer generations require from a financial institution moving forward,” said Robert Bender, community banking executive at First National Bank of Elmer in southern New Jersey. “It’s an interesting dynamic that’s evolving.”

Regulation

Banks report that regulators are sticking to their knitting—liquidity, Bank Secrecy Act compliance, interest-rate risk, and portfolio concentration—when it comes to oversight during bank examinations. But information security and technology are growing areas of scrutiny given their systemic importance and risk profile in the industry.

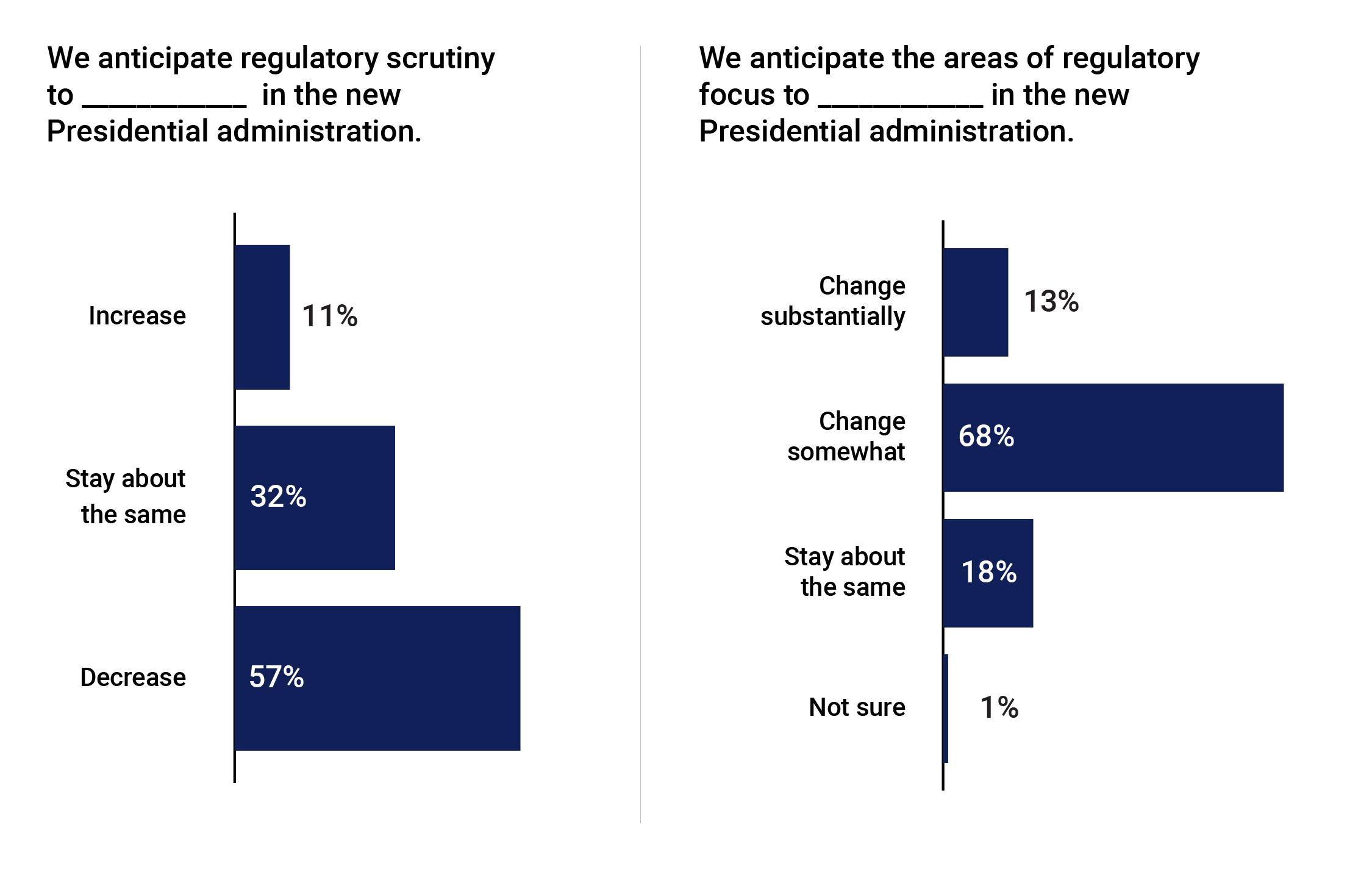

On balance, the intensity of examinations has remained about the same for banks as last year, while a majority (57%) said they expected scrutiny to decrease under the new Presidential administration. However, regulators’ areas of focus may well change (see Figure 6). The entities regulating the respondents are the FDIC (40%), OCC (24%), Federal Reserve (22%), and state banking authorities (13%).

Figure 6. Less regulatory scrutiny, but regulators may well focus on new areas

Being Nimble: A Whale of a Value Proposition

In written comments, many survey respondents said the ability to be nimble was a primary driver of community banks’ success. Council members outlined several areas where flexibility can be beneficial—from aiding the community and customers, to streamlining operations and fighting fraud.

“We had a flood here in Wisconsin a few years back and we were able to quickly offer short-term loan products to clients to help them clean up their properties,” Torres said. Recently, she added, she was able to quickly put a donation in place for a student investment challenge.

Describing a scam similar to the phony fraud department exploit outlined by Torres, Cavanaugh recalled the quick response of a community bank in her region. “Within hours,” she said, it updated its website and sent a mass email to customers saying, “we would never ask you for account information” and “we'll never ask you for credentials” via text message. The institution also manually reviewed transactions “for anything that looked unusual.” “The bad guys figured out they weren't going to get anywhere and went to the next target,” Cavanaugh said.

Ingari recalled that community banks were the driving force in the quick distribution of the economy-boosting Paycheck Protection Loans during the pandemic. At her bank, she said, employees from different departments pitched in, and the bank quickly issued three times its average annual loan volume. “Smaller banks have ability rally the troops and get everyone on board,” she said.

Bender said, “As a community bank, being nimble can potentially benefit our bottom line while better serving our client base. We sometimes have the ability to change course more easily in terms of strategy and expense management. If market conditions change and we want to delay an investment or expense, we have more of an ability to do that,” he said. “We are constantly looking at our financial metrics to be ahead of the curve.”

A bank’s ability and willingness to act on new information can sometimes lead to surprising and positive results, Cavanaugh said. Her institution once came to the aid of a local aquarium that had an unexpected opportunity to acquire whales. There was not enough time to establish a fundraising campaign—the typical approach. It took “a phone call to the chairman of the board,” she said, and the deal got done. “It was an opportunity that they needed to respond to quickly,” Cavanaugh said.

Closing Thoughts

Being nimble is important, but it’s also that ability to be responsive that makes other community banks the main competition for this industry segment—named by 47% of respondents, far more than regional/super-regional banks (29%), credit unions (14%), fintechs (5%), and large banks (3%).

One respondent cited their bank’s “close relationship with our customers and communities” as its most powerful competitive asset, a sentiment echoed by many.

No matter how community banks evolve in the face of current and future challenges, including a potential fresh wave of mergers and acquisitions, ProSight Community Bank Council members and survey takers are working to ensure they remain in a strong position to continue their vital function.