Quantum Computing Is a Boardroom Priority

3/1/2023

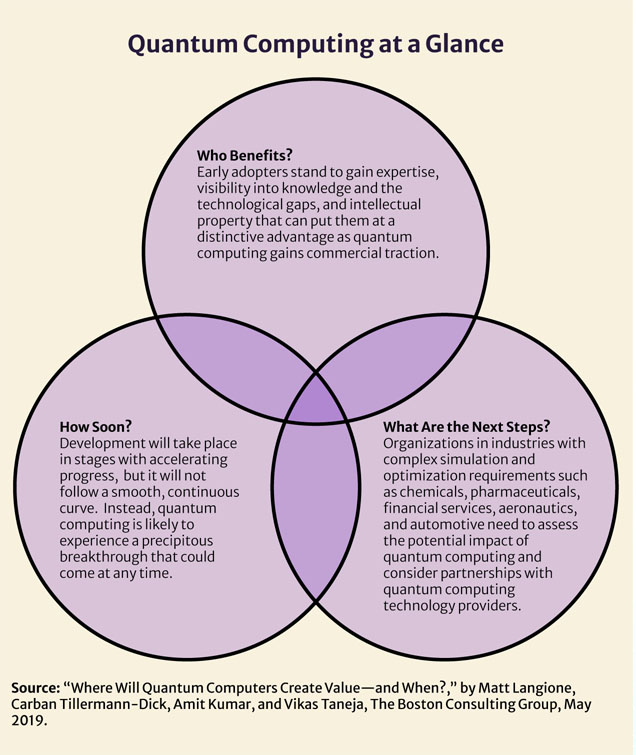

Quantum Computing at a Glance

If the 1970s was the dawn of the information age, we may look back on the 2020s as the start of an era driven by quantum computing. It might also be remembered as the time when organizations succeeded—or failed—in preparing for a paradigm shift in computing.

The power of quantum computing has the potential to lead to major advances in healthcare, aerospace and defense, chemicals, information technology, and pharmaceuticals. A recent article in Tech Monitor says the earliest widespread adopters could be banks, which are exploring ways it can revolutionize fraud detection and derivatives pricing.

“Quantum computing will be able to perform calculations that are simply impossible to tackle with any device created up to this point,” said Mauro F. Guillén, Dean of the Cambridge Judge Business School at the University of Cambridge. “Quantum’s potential is almost impossible to imagine.”

Also hard to grasp: The science that will power quantum computing. Consider the phenomenon of quantum entanglement—in which paired particles act in a correlated way regardless of how far apart they are. (More on that later.) Or the key principle of superposition, which left Schrödinger’s Cat simultaneously alive and in need of another of its nine lives in a famous thought experiment.

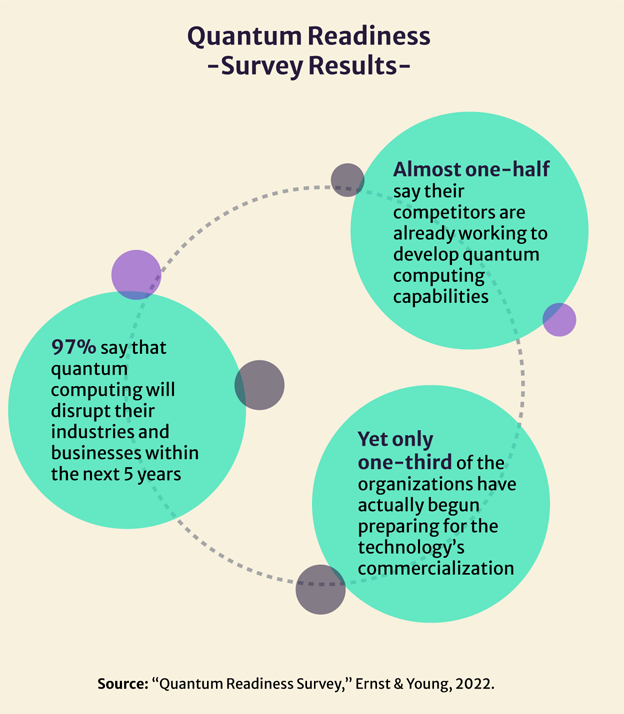

Luckily, board members will not be called on to explain such mindboggling matters. But they will need to understand and appreciate quantum computing, which has the potential to create enormous opportunities and risk. Whether a business thrives in the future may very well depend on its readiness for what lies ahead, a recent paper by Ernst & Young says.

This article provides a quick—and hopefully not too technical—primer on quantum computing, a look at how it could affect information security and banking, and questions bank directors should be pursuing as the quantum era approaches.

Quantum Readiness -Survey Results-

A Quantum Computing Primer

Perhaps the most important thing to know is that quantum computing is not just a faster version of classical computing. It is fundamentally different. It is a type of computation whose operations are able to harness the phenomena of quantum mechanics—the behavior of energy and material at the molecular and atomic levels. Quantum computers involve millions or billions of computations conducted simultaneously at significantly accelerated speeds.

While today’s computers encode information in bits that have two values— zero or one, on or off—quantum computers use quantum bits (qubits) that can take an infinite number of values. This “superposition” allows an object to simultaneously exist in multiple states and places (like Schrödinger’s Cat). In an article for the Office of the Dean of Research at Princeton University, author Tom Garlinghouse says this quality allows quantum computers to consider significantly more data at once and evaluate more outcomes, increasing calculating power exponentially.

A description in the Harvard Business Review article “Quantum Computing for Business Leaders” gives a straightforward example of how quantum computers could solve problems exponentially faster than classical ones. Imagine a two-dimensional maze, authors Jonathan Ruane, Andrew McAfee, and William D. Oliver say. A classical computer needs to run one linear path after the other until it finds the way out of the maze. If the maze comprises 256 possible paths, the computer needs to run through the maze 128 consecutive times (on average, one-half of a maze’s paths must be tried to find the right one).

But a quantum computer is able to process all 256 pathways at once. Put differently, an 8-bit classical computer represents only a single number from 0 to 255, but an 8-qubit quantum computer can represent every number from 0 to 255 simultaneously.

Until recently, quantum computing has been largely theoretical and confined to scientific laboratories and research universities. But that’s changing.

Accenture estimates that private and public spending in this area is expected to surge by at least 35 times in this decade. Advantages are likely to be gained by companies that are able to leverage the potential of quantum to solve real problems and generate insights about their customers, operations, and strategies to transform their business.

In “How Can You Prepare Now for the Quantum Computing Future?”, Ernst & Young Partner Harvey Lewis says quantum computing is likely to create disruption sooner than expected. Already, organizations have access via the cloud to quantum computing that allows them to experiment with problems that could never be solved using classical computing.

The State of the Technology

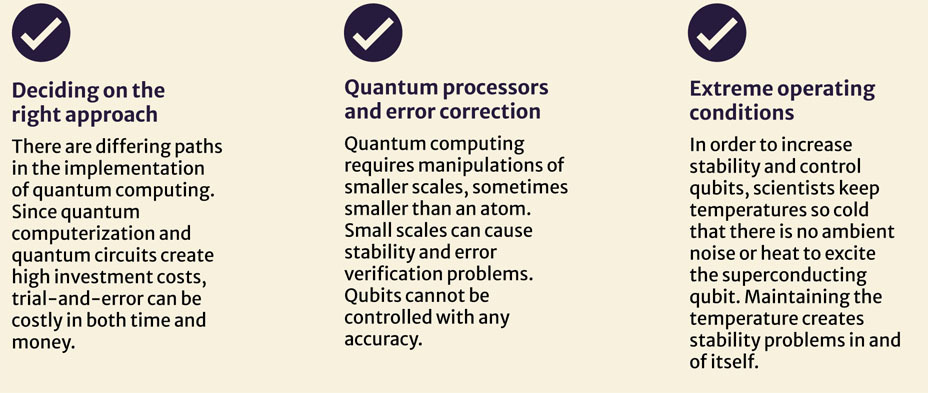

Deloitte suggests that due to the underlying physics, it is challenging to keep collections of qubits working together. Qubits are notoriously unstable and need to be isolated in a controlled state. Some quantum machines do this by cooling them to temperatures of hundreds of degrees below freezing while others entrap them in ultra-high vacuum chambers. As a result, today’s quantum machines rely on customization and are confined almost exclusively to laboratory environments.

Bernard F. Mathaisel, co-author of “Navigating Information Technology in the Boardroom” and an advisory committee member of the American Honda Finance Corporation, says, “The prototype quantum machines today are large, unwieldy, and prohibitively expensive. A concern with secuthe technology is that the qubits are extremely fragile and can be compromised by the tiniest disturbance. Only smaller-sized quantum computers have been built to date that have a limited number of qubits. These problems need to be addressed before businesses begin broadly investing in the technology.”

Other impediments to adopting quantum computing include the following, according to KPMG:

- Evolution of the technology. It can be difficult to identify which of the technologies will prove suitable to run commercial applications. There are different approaches toward building the computing capabilities depending on the type of qubit technologies used at the hardware layer.

- Limited use cases. The use cases are limited, so organizations remain cautious. The trepidation is understandable given the challenges they face in defining problems that could be addressed by quantum computing.

- Shortage of specialists. The specialists needed to understand a combination of physics, mathematics, and computing are currently in short supply. Moreover, organizations experimenting with quantum computing need people who understand the business and are able to identify the problems it could address. For the foreseeable future, organizations will find it challenging to build capabilities due to this significant shortage of resources. 1

Information Security Implications for Good and Bad

Quantum computing has the potential to render communications more secure. Because of the aforementioned entanglement quality of quantum mechanics, two qubits can be linked together in such a way that a change to one causes a change to its corresponding qubit. This occurs without time lags, over long distances, and without any physical connection such as cables or radio waves. “The clever thing is that the quantum state of the qubit changes with every unauthorized access, for example, an attack from a hacker. The parties to the communication would perceive this as a disturbance in their communication, would be warned, and could deploy a new key…. Quantum technology could be used as an effective way to secure the internet and the communications in the internet of things,” said Shohini Ghose, a professor of physics and computer science at Wilfrid Laurier University, in this interview.

But the power of quantum, conversely, can also be a mammoth security risk. Futurist Bernard Marr writes that quantum computing is a serious threat to the digital encryption used today to secure virtually everything online, as well as critical communications and information such as military, commercial, and national security secrets.

Why? Encryption uses methods that would take classical computers many years to crack through brute-forcing every possible password or key. But thwarting encryption with a quantum computer is almost a trivial matter. “If I have something encrypted on my machine and it’s broken by somebody in a few million years, I’m not likely to care that much,” Marr says. “But then it turns out that… with a quantum computer, it can be decoded like, now… this becomes an immediate problem!”

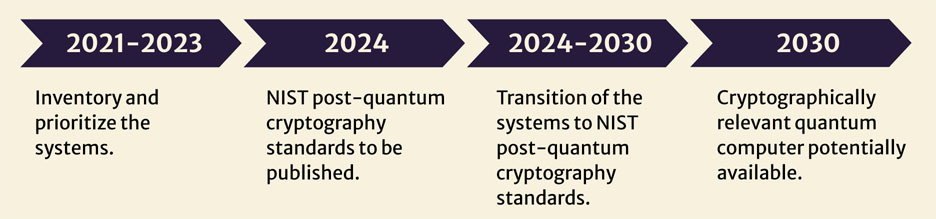

The National Institute of Standards and Technology conservatively estimates that within two decades, quantum computers will be able to break essentially all public key schemes currently in use. But Google CEO Sundar Pichai has warned that quantum will be able to break current encryption methods within five years. It is likely that data and cryptographic assets are being captured and stored by evildoers today for decryption tomorrow (a so-called “harvest now, decrypt later” attack). The Cybersecurity and Infrastructure Security Agency recommends that all critical infrastructure owners and operators begin following the Preparing Critical Infrastructure for Postquantum Cryptography guidelines released in October 2021.

Applications in Financial Services

- JPMorgan Chase & Co. and Citigroup are establishing quantum computing programs and acquiring stakes in startups. JPMorgan is experimenting with Honeywell’s quantum computer in an effort to ease mathematical operations.

- Wells Fargo joined with IBM and a community of companies, startups, research universities, and laboratories to explore practical quantum applications.

- BBVA is exploring quantum use cases to test the dynamic optimization of its investments and loan portfolios.

Source: “How Quantum Computing Could Change Financial Services,” by Miklos Dietz, Nico Henke, Jared Moon, Jens Backes, Lorenzo Pautasso, and Zaheen Sadeque, McKinsey & Company, December 18, 2020.

Andersen Cheng writes in “Why Quantum Computers Are a Risk to Your Business Today, and What You Can Do About It” that many organizations will need to overhaul their entire information security and cryptographic infrastructure to ensure it is quantum-safe. The process for deploying new cryptosystems could require upgrades or replacements to software, hardware, and the communications infrastructure. Existing data will need to be re-encrypted and infrastructures built to support the new cryptographic algorithms. The transition is likely to be complex and could take years.

Some experts predict that the disruption could eclipse the work to mitigate the Y2K challenge, which cost governments and businesses worldwide enormous time and billions of dollars. Ruane, McAfee, and Oliver say companies may need to begin demonstrating to the regulators that they are on track to being quantum compliant.

Opportunities Abound

But just as quantum can crack security codes in a matter of minutes, it could also solve problems that would take classical computing hundreds or even thousands of years, Deloitte says. One of the most immediate opportunities for quantum computing is the processing of large amounts data necessary for AI and machine learning, which is limited by today’s computational capabilities. The processing power required to extract value from the swaths of data currently being collected is escalating. Quantum computing can open up new possibilities with AI. Suren K. Gupta, executive vice president of technology and global operations with Allstate Insurance and a board member of Zions Bancorporation, says, “Quantum computing will unleash new frontiers of innovation through the use of advanced artificial intelligence and machine learning.” The International Data Group predicts that one-quarter of Fortune 500 companies soon will be using quantum computers and gaining competitive advantage from them.

Implications for Financial Services

McKinsey says there are promising use cases in investment management, loan portfolios, and risk management. Quantum-optimized loan portfolios that focus on collateral could allow lenders to improve their offerings, lower interest rates, and free up capital.

Many activities in financial services, from securities pricing to portfolio optimization, require the ability to assess a range of possible outcomes. To accomplish this, banks use algorithms and sophisticated models that calculate statistical probabilities. While these models are effective, they are not infallible, as was demonstrated during the global financial crisis, when low-probability events occurred more frequently than projected. McKinsey notes that in today’s data-centric world, more powerful computers are needed to evaluate the probabilities accurately.

Financial organizations that harness quantum computing will be able to more effectively analyze large or unstructured data sets, McKinsey adds. Sharper insights into these domains could help banks make better decisions and improve customer service— for example, through timelier or more relevant offerings such as a mortgage based on browsing history. There are a growing number of use cases in capital markets, corporate finance, and portfolio management. In an increasingly commoditized environment, quantum computing can be a new route to competitive advantage. Quantum computers could be particularly useful where algorithms are powered by live data streams, such as real time equity prices that carry a high level of unfiltered noise.

Preparing for the Quantum Future

As companies look ahead to a future with quantum computing, Deloitte recommends the following steps:

- Evaluate the possibilities. The board and management need to be informed about the technology’s progress and evaluate how peers, competitors, and ecosystem partners are investing in and experimenting with the technology. The potential impact on the industry and the organization needs to be assessed.

- Create a strategy. The board and management should decide on a quantum strategy. The plan may be to do nothing for now, but begin preparing for what is next. It is important to assign responsibility to someone with the skills, knowledge, and organizational stature to execute the strategy when the time for action arrives.

- Monitor developments. The strategy needs to evolve as the technology and market change.

- Explore and experiment. There are cloud services now that allow organizations to use algorithms and compare different hardware architectures by experimenting with pilot cases. 2

Questions Directors Should Ask About Quantum Computing

- What problem(s) has the organization not been able to address using high-performance classical computing? How critical is the solution to the organization’s success? How could the business be transformed if this problem could be solved?

- How should the organization become engaged in quantum computing? What can the organization expect to achieve with quantum computing and what level of investment is required and over what period of time?

- What is the board’s level of awareness of the opportunities and threats posed by quantum computing? Why should it be a board priority?

- How should management engage with the quantum computing ecosystem? What needs to be done, by whom, by when?

- How are competitors responding to the possibilities of quantum computing? What impact could quantum computing have on the industry and adjacent sectors?

- How could the arrival of quantum computing affect the organization’s plans to invest in artificial intelligence and machine learning, blockchain, and other new technologies?

- What quantum skills are required to pursue the opportunities and address the threats? How will gaps in talent be addressed?

- In what ways could quantum computing be integrated with the organization’s existing IT architecture? What upgrades are required?

- How can the organization protect its data and customer information from evildoers who could use quantum technologies with malicious intent? What should be done to prepare for post-quantum cryptography? How can the organization protect against a “harvest now, decrypt later” attack?

- What ethical risks need to be considered (and mitigated) to prepare for the future of quantum computing?

- How can the board remain informed of the trends and developments in quantum computing?

Board members and management need to make informed judgments on when a commercially relevant quantum computer is likely to be available. Ruane, McAfee, and Oliver say it is instructive to recall that the transistor was invented in 1947, yet the first four-bit processor was not introduced for 25 years. It was another 25 years after that before Intel developed a chip with millions of transistors. Quantum computing is not likely to make or break your organization in the next year or two. But an evaluation of the possibilities is crucial for preparing the company to seize the opportunities and thwart the threats.

Notes

DEAN A. YOOST is the author of five books on corporate governance. He is a board member of both MUFG Union Bank and Pacific Life Insurance Company and an advisory committee member of American Honda Finance Corporation. Dean is a retired partner of PricewaterhouseCoopers where he spent 33 years. He can be reached at deanyoost@cox.net.